Settings

Workflowsالقوالبالدردشة مع الذكاء الاصطناعيصور الذكاء الاصطناعيفيديوهات الذكاء الاصطناعيالروبوتاتالنسخ الصوتي بالذكاء الاصطناعيتحويل النص إلى كلام بالذكاء الاصطناعيAI استوديو الصورAI Headshots Generatorمولد التصميم الداخلي بالذكاء الاصطناعيBrand Voiceالدليلحلول الأعمال التجاريةما الجديداتصل بنا

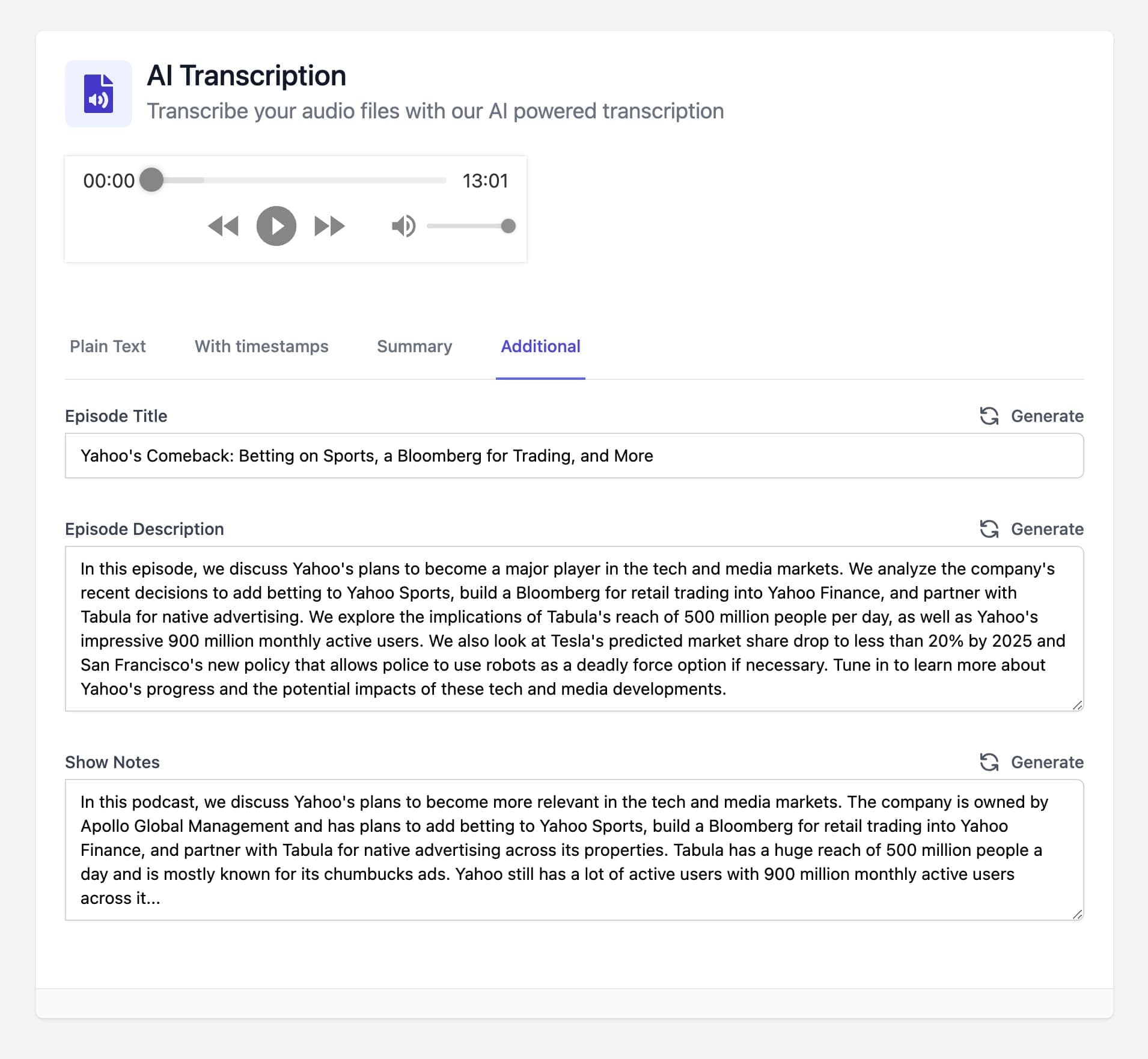

تسجيل الدخولSign up for freeمنصة الذكاء الاصطناعي الشاملةنسخ بودكاست بالذكاء الاصطناعي، تلخيص، ملاحظات العرض، والمزيد

منصة الذكاء الاصطناعي الشاملة

نسخ بودكاست بالذكاء الاصطناعي، تلخيص، ملاحظات العرض، والمزيد

حول بودكاستاتك إلى أصول محتوى جاهزة للاستخدام، فورًا. تقوم خدمة نسخ البودكاست المدعومة بالذكاء الاصطناعي لدينا بتحويل حلقاتك إلى نص، ملخصات، ملاحظات العرض، محتوى وسائل التواصل الاجتماعي والمزيد.

876,388+ مستخدم سعيد

🚀 مدعوم بأفضل نماذج الذكاء الاصطناعي

🌍 يدعم أكثر من 40 لغة

💳 لا حاجة لبطاقة ائتمان

Transcript

Hello, I'm Suen Tan, business correspondent at The Straits Times. You're listening to Head Start on Record,

our newly revamped podcast series by The Straits Times that gives you a leg up in money and career matters.

Finance literacy experts keep saying, start early. But how early is early enough? Can an undergraduate without a full-time job start investing with just $100 a month? And if they choose that path, what should they look out for? Universities here even have clubs that help undergraduates to start investing. Over at NTU, the Investment Interactive Club helps to link students to the finance community and hone their practical investing skills. It was founded in 1999 and now has over 5,000 members. With us, we have a professor who spent 30 years in finance before turning to academia full-time in 2023. He is associate professor of finance, Matthew Dirth from NTU. We also have NTU undergrad and budding investor, Victor Tan, aged 20. He started investing at 18 and aims to be a financial analyst when he graduates. Welcome to the show.

Great. So Victor, how do you start investing and why do you decide to begin while in uni?

Sure. I actually started investing when I was 18. Without much financial knowledge and experience at the time, I was actually inspired after reading a book titled Rich Dad Poor Dad by Robert Kiyosaki, which really educated me of the importance of really building assets from a young age. So I initially invested $500 back when I was 18 years old, hoping to benefit from the compounding effect as soon as possible. So I actually consulted some friends and dove into resources like Investopedia and YouTube to learn about different types of securities and their characteristics, which I eventually decided to invest in funds. So how I invest is that I actually visited a local bank and learned about the products available. I chose mutual funds because I thought that having a professional managing my funds would be safer given my lack of experience. And I was lucky enough to meet a clerk who was helpful enough to guide me to the right products. Right.

Okay. So you started with $500 a month. How much do you put in now a month?

Wow. And have you? Have you changed your portfolio in any way since then? Right.

So back then I actually only invest in like mutual funds. So right now I actually invest through the Moomoo app. So how I adjusted my portfolio is I actually started to invest in money market funds. It's a type of fund targeted at the money market. Although I feel that the return of money market is relatively low, but I decided to do that because I believe that having some returns while I continue to learn more advanced financial knowledge will be better. And also the other half of my portfolio, I actually invested in the Moomoo app. It's actually being invested at mutual funds targeted at tech stocks in the US, which I personally have interest in and I have done my research in it. Wow.

And for Prof Matt, do you actually see more younger people investing these days? Because 18 years old is so soon, right? So early to start.

It is. It is very early. But I mean, if you go back to when I was growing up in the US a long time ago, the world was very different. It was very hard to get information. It was very hard to get information on anything related to investing. So you'd have to get to the back of the newspaper. It would be a really daunting column of, you know, all the little numbers and you didn't know what anything meant. So the people that I knew that got into investing early and in university, so some people did at that time, they tended to have a family member who was in the business. That was usually the way that people started. But if you fast forward to today, I think it's a lot easier for people to start as we just heard from Victor. The access to information is orders of magnitude easier, better, broader than it was before. And we've got a lot of new technology and tools that are available. So I'd say, you know, whereas before it was harder to get information, now it's easier. Before it was expensive to trade. Now it's cheap or free, right? And you have things like Robinhood in the US. You have the robo-advisors that have come up. I'm sure we'll talk about those. You have crypto, you know, there are tons of things out there that are, I think, a little bit more accessible and of interest to younger investors.

Yes, right. That's so true, right? Like with online, social media, there's just so much information that's out there. But do you think that there is an ideal age or recommended age that people should start investing?

Honestly, just as early as possible. And Victor said it. Take advantage of the compounding effect. Albert Einstein actually was the one who described compound interest as the eighth wonder of the world.

So, you know, when you let your money keep generating returns, income, and it compounds through time, it's a magical thing. It's very powerful. So to be able to start early makes a huge, huge difference. The other reason why I'd say start early is because it's a magical thing. Because if you're going to make mistakes as you get started, make them with small amounts of money, right? It's better to do something dumb when you're not risking, you know, a lot of money that you've been saving up as a mid-career professional, right? So I think the combination of those two things makes me say, get started as soon as you can.

Well, thank you for that. And for Victor, you are from an NTU investing club. So are your peers also investing? And how does this club help undergrads to start putting their money into something?

Okay. So basically, I'm from the Investment Interactive Club from NTU. So how we help general investors is that we actually have educational sessions conducted weekly. So one of the sessions is usually for beginner investors who we will teach about basic economic and investing concepts, whereas the other is for more advanced investors, which we will teach about like valuation methods. So I believe these two types of courses, they help different types of investors based on their experience level. So. My peers in the club are actually, everyone is basically investing, but I will say that everyone has their favorite securities to invest in. So what I know, right, is actually most of my peers, they actually started to invest in fixed deposit because that is allegedly the safest security that you can invest in. While even some experienced peers are even trading stocks since a young age. So yeah, I agree with Prof. Matt, as he mentioned that investors are generally getting younger as a lot of information and also a lot of organizations are working. Hard to really instill financial literacy among the youth generation. So yeah, that really sums it up. Right.

So when you started investing at 18, were your peers also at that age already thinking of investing or was it just you?

I would say my peers during when I was 18 years old, we actually did not have much knowledge about what kind of securities are there to offer. We only know about the conventional bank fixed deposits. So I guess I'm quite early to really interact with this kind of new securities. These are bonds, stocks. And all these products. So yeah.

Right. Okay. And for the NTU Investing Club, are there other activities that you do besides teaching people to invest? Like for example, business networking?

Right. So for our educational events, we actually offer networking sessions with industry professionals. Not only that, we also hold like five financial events which targeted the entire community of Singapore. So we actually have five financial events, namely the National Cash Flow Competition, Singapore. Singapore Financial Conference, Alternative Investment Symposium, the Eurasian Asset Management Challenge, and also the Singapore Global Money Week. In essence, all these financial events, we aim to instill financial literacy among all generations in Singapore. And we actually work with government agencies, external companies, and also NTU clubs with the same goal to really further educate financial literacy.

And just curious, Victor, because since you started investing at 18, like did your parents know about it at that time? Or did they have anything to say?

My parents were actually quite conservative about investing because back at that time, I would say they only know about securities like fixed deposit. They would assume that there's the best securities to invest in. But I insist on my ground because I believe that, as Prof. Matt mentioned, the compounding effect is one of the magic of... Yes. So yeah, I insist on my ground that I just like convince them that it is a thing that I should do since a young age. And I pretty much just show them like what are the available skills. And just clarify their doubts on like maybe the risk that they assume in investing in like all these securities.

Yeah, I think that is quite an interesting thing as well, right? Like different takes that different generations have on investing. Like now, maybe it is so accepted that we can start when we are 18 to 20. But for our parents' generation, maybe they would be 30 and they still would not be starting. So I think, Prof. Matt, this is also a question for you, which is that for young people who have not started full-time work, especially, what sort of products can they start investing in?

Yeah, it is a great question. And it is interesting, Victor, to hear you say that you kind of started out with fixed deposits because I do believe that when you are starting out young, you have got time on your side. And that magic of compounding is really the incredible force that you are trying to benefit from. So what I... This is personal, like dad speak, you know, as I am talking to my 20-something-year-old boys, telling them that they should invest in the stock markets, broadly speaking. And they should probably invest through funds. You highlighted, Victor, that you are investing through funds. So these could be mutual funds or exchange-traded funds or ETFs. And, you know, honestly, I think the best thing to do is to use a robo-advisor. That is the advice that I have given my kids. And one of them took me up on it and he takes, you know, 15% of his monthly allowance and it automatically just rolls into his robo-account. And it goes into a portfolio of different ETFs. Representing different types of stocks, different segments of the market. And that portfolio construction used to be very expensive to get in terms of advice. You had to go through a financial advisor. And now it is free, essentially. I mean, you know, you just sign up for one of these and you can put as little as $10, $20, $50 a month into one of these accounts. So that is my advice. And I think that the temptation, if you will, to invest in individual stocks, trade some crypto, all that kind of stuff, it is not that it is wrong. But I think if what you are trying to do is really build long-term wealth, you need to build a foundation. And that is where I see a diversified portfolio of exposure to the equity markets through something like a robo to be a very effective way to start. Right.

This goes really nicely into our next question, which is, you know, how do you describe your risk appetite, Victor? And then for Prof as well. Like, what is your risk appetite? What sort of risk do you think people should take on at this young age? Or how much should they even put in a month?

So I actually consider myself as having a moderate risk appetite because I personally feel that I am not worried about like short-term price volatility in my assets. But I definitely will not invest in any securities without conducting thorough research myself. Hence, I will not defend myself as an aggressive investor in that sense. However, I believe like with my further course and modules in my university, and also I have taken personal courses. My risk appetite may become more aggressive in the future. So hence, with the increase with the financial knowledge, I'm confident that I will be more confident investing in riskier securities that may be stocks or commodities on securities like this.

So I guess the question I'd throw back to you is, you know, how do you think you're going to beat the market? Right. So you're competing in the market is this amazing information exchange where all sorts of professionals and individuals are competing at this. And you're competing at the same time, essentially, to have the kind of the right outlook for security, if you will. And in my experience, consulting with professional investment managers, the very best of them are right about 60% of the time. That's it. So I always I always ask my students, so why do you think you're going to be great at picking individual stocks? Right. So I don't know if you've thought about it that way before, but. Okay. Right.

So my investment goal. It's really not to beat the market, but rather I will say that my goal is really to take the same around average return as the market itself, because there are actually some broad indexes that you can go for. Maybe like the S&P 500, Dow Jones and all these. And in order to beat the market, you really have to be very skilled and which a lot of funds and a lot of asset managers also sometimes hard to beat the market. So personally, as a retail investor, as an amateur investor, I will say I personally do not aim to beat the market. Yeah.

I think that's very, that's very wise because it's very hard to beat the market. When we read the financial news, we'll always read about some guy who, you know, ran a fund for 20 years and he beat the market every year for 20 years. Statistically, that is likely to happen because there are thousands and thousands of professional money managers. So if you just think about a getting a little, you know, kind of academic here, but imagine that there's a distribution curve of returns from the people that are really, really, really, really terrible losing all their money on the left to somebody on the right who's been able to beat the market every year for 20 years. We only hear about the right tail. We don't hear about the left of people who are just terrible at it.

There's a wonderful book that I would recommend to your listeners called Fooled by Randomness. And the author is Nassim Taleb. He also wrote The Black Swan, which is probably as a concept better known, but Fooled by Randomness walks through some of these concepts. And I think it's absolutely a critical book for people to start out by understanding that a lot of what we think in the market is skill is actually kind of luck, right? And being able to disentangle luck and what happens in the market from what your true investment skill is, most professional investment managers don't actually know that as well as they might like to. And individuals would have a really hard time understanding. Was my success? Was my success driven by luck or skill? I don't know. So with that in mind, then thinking about, well, how are you going to invest and how are you like, how much money are you going to put in and things like that? It's kind of humbling, right? It's like, should I really think that I'm going to be this awesome investor? And so should I risk a lot of money? You know, I always say just, you know, start investing just to start investing, because now you've got money in the game, right? Now you're watching. Right. You're learning, you're incentivized to pay attention. And then over time, especially if you start out with something like, you know, robo advisors and a diversified portfolio of stocks and maybe some bond funds in there, that sort of thing, you know, then you can layer in some of the single stocks if you really like that. Right. And go into some of the riskier instruments, too. But to just jump right into picking single stocks and then going in and putting it all on crypto or something, I mean, it's like that's that's. There are going to be people who are successful with that, but it's probably more luck than skill.

Okay. So we've talked a lot about the do's and don'ts of investing as a first timer, but what are the top investment mistakes that you have made?

Okay. So I will say one of my biggest mistake is sometimes I feel myself as being a too conservative investor in times where, like, I have enough understanding on the market and maybe some companies, but I do not have the confidence to really invest in it because I've been a bit too conservative. I thought that it will be actually very risky. I might lose my money. So, yeah, for example, during the starting of this year, there's actually an AI trend that's very high right now. So back in January, I was actually very motivated to research into this market, but eventually I only invest like half of my portfolio in it because I really thought that it couldn't sustain longer. But yeah, as we know that all of these tech stocks are actually quite high in value now. So I will say my biggest failure was that I've been talking about the do's and don'ts, but I've been talking about the do's and don'ts for a while now. And I didn't have the courage to really invest a huge money in it.

And for Prof. Matt, I think you have had many more years of investing experience.

Time in the market gives me lots of mistakes to talk about. I'll highlight two because they're very different mistakes. One was probably in about 2000, I'm going to guess 2006 or 2007. I was talking to some folks in the business and we were looking at a little stock. It was an ADR. So it was a foreign stock that traded in the US. It was a Peruvian oil and gas exploration company. And the speculation was that they were starting a drilling routine offshore and they were going to find deep water oil. Okay. So I put, I don't know, not a lot of money, you know, $10,000 or something like that to be able to have some exposure to this thing and it didn't work. Now, what you should do if you go into a trade with a very specific objective is if it doesn't work, you sell it, right? Unless there's a new reason, new information, why you should continue to own the stock. I owned the stock even though the reason why I owned it was gone and wrong. And ultimately it went to zero. It literally delisted and I lost every penny. So that was the first mistake. That's a. Single stock kind of mistake. The second mistake that I would highlight is I think it was during the global financial crisis. I sold a bunch of stuff because I was getting really worried about the market. And so I had a lot of cash in my account. And I said, okay, I need to go, you know, have some cash here just in case. Right. And for a little while, it looked like it worked. The problem is I never put the money back in the market. And so then the market rebounds, recovers, it keeps going. And I'm just sitting there with all this cash. And then the market keeps going, ah, it's too late. I can't put the money back to work now. And then it keeps going. Right. And so I should have taken a bunch of money and like tripled it coming out of this volatility. Um, but I didn't. So knowing that if you have a reason to get out of the market, my learning loss, I think, I'm going to take a lesson out of that is write down somewhere what it would take for you to get back into the market. And that way you can go, you take the emotion out of it and you can just go back and refer to it and say, when I made this decision, this is what I thought I was going to do. And so then you're not relying on, you know, kind of your emotional state when it gets there to say, oh, yep, I said I was going to do this. So now let me go do it. And I would have made a lot more money as a result. Right.

So it's more like setting the clear goals and targets, right? So you're not just ruled by your panic or your emotions.

That was an emotional trade. Well, it was probably 50-50 emotional and thought behind it. But then to put the money back into the market, then I got lost in the emotions and I couldn't make the reinvestment decision nearly as effectively as I should have. So two very different kinds of mistakes. I got lots more. That's what happens when you spend time in the market. You will make mistakes.

Right. Yeah. And I think that's an issue as well, right? Because on social media, they always recommend picking individual stocks and there are all these different, for example, the US tech stocks that people recommend as your first investment and people just go into that without really doing research. So, I mean, Victor, is that something that you have seen your peers do or is that something that you would ever do yourself?

No, I actually don't observe this situation among my peers. Because I think what we have been believing is that we do not know what is the true intention of the content creators while making the investment recommendations. I mean, some, they could be doing the recommendations for publicity purposes, but I do believe that some are really for educational purposes. But I think in general, it's important for investors, especially for beginners, investors to really look into the reasonings of the content creator and make some research and determine whether their advice are true or beneficial to you.

That's very wise, actually. Yes. Yeah. And for yourself, I mean, I think you mentioned like speaking to actual professionals and people who are investing professionally and speaking to fund managers as well, right? But where else do you get your knowledge from? Do you read, for example, analyst reports or, you know, how do you make sure that you stay on top of the market? Right.

So, basically, I have a group of friends where we will actually take turns to read the market news and we will make a market roundup reports by ourselves, by weekly. So, we will take shifts to do that. Great. So, we will read through each other's work because sometimes you may not be free in some weeks. So, in that case, it's a good opportunity for us to really look through what is going on in the market every week in a consistent basis. Wow.

I'm really impressed. Yeah. Because I think this also happens, right? Which is people like to react impulsively or emotionally, especially if they are first time investor. I think in the last few weeks, we have seen like some market shocks and things happening that could have wiped. Most people like US equities, for example, if that's what their portfolio is heavily weighted in. So, how do you like kind of train yourself, Victor, so that you are not afraid or you don't panic and make impulsive decisions? Right.

As you mentioned, for the last few weeks, it was really rough for a lot of investors. Yes, definitely. I actually got pretty anxious during that time. Yes. But eventually, I actually just sat down and reflected on the market trends. Then I just thought that it should be only a short-term volatility. Yes. So, all I believe is that you do not time the market, but what we should do is really let the time be your friend and just use the compound benefit because in the long term, the investment is definitely going to go up in value as what statistics has shown. So, yeah. I mean, how do I train myself to do this is that just sit down and just reflect on what is the current market trends and think back initially, why do you chose to invest in this? Because the reason you invest in this probably has gone through a lot of research and homework by yourself. So, you should stand on the ground and not let your emotions control you.

Right. So, it's really just the age-old advice of taking a step back, having a cup of tea and deciding that life is okay. Okay. And for ProfMed as well, because we know that, especially uni undergrads, they're not full-time traders, right? And you were mentioning that it's very hard because even professionals don't always get it right. So, what sort of options are accessible to them in terms of where they can get their knowledge from? I think we've heard from Victor for some of the things that they do as business. Yes. School students. But I guess for the general mass of students, where would they actually go to for advice if it's not TikTok and social media?

It's a great question. And one, I'm like, hey, boomer, it's a little hard for me to answer to a certain extent because these guys are so much younger and we didn't have any of these kinds of resources like Reddit groups and any of that when I was growing up. That said, if what you are going to do is try to build from a very stable base, if you're young, you should be getting equity exposure, not fixed deposits. You can afford more risk. You mentioned compounding again, like the expression is you want time in the market, not timing the market, right? Most of us are terrible at market timing. We panic and all of that. So, if you've kind of set yourself up to have something kind of go in an automated way, you're getting, you know, kind of consistent exposure to equity markets, you have time to do a little reading. You have time to do some homework. Don't look at the value of your portfolio every day, right? I have an app for my portfolio. I haven't opened it in months, right? Because I know that when I set it up, I set it up well to carry me through choppy markets, right? So, I don't have to look at it. So, what can you do? Where can you get your information when you're young and you're trying to learn? You know, I think that there are going to be some good basic books or websites like an Investopedia is a good one where you can learn about concepts like diversification of portfolios, compounding, dollar cost averaging as a way of putting new money to work, things like that. So, I think it's really kind of about stepping away from the social media sources. Again, it's hard to assess quality. It's hard to know what the motivations are behind the people that are making these and go to where you can see, you know, this is something that appears to be relatively professionally done. And just read. Be a sponge, right? As much as you can, if you're excited about it, that's where I'd start. If you're not excited about it, right, you don't really get energy from trying to think, oh, I'm going to pick the next Nvidia, then actually just do the basics. Just save, put the money in the market, and let time work. You don't have to be an expert. You don't have to try to beat the market.

Right. Because things like robo-portfolios, they can just balance it for you. Exactly.

That's really good advice, actually. Yeah. Especially now when there's just so much information floating everywhere, right? Yeah. Yeah. So, for Victor, I think we've talked a lot about your investment journey. What lessons do you think you've learned and how do you think they can apply, you know, even in your future career, for example?

Right. As mentioned, the rough markets have actually made me a bit anxious. So, I guess the most important lesson that I learned was that I should not let any emotions control myself, my actions, especially during investing and in my career. So, I think this lesson is really important. This lesson will definitely be useful in my future career and, you know, investing in general, as I believe discipline is what sets one apart from others.

Okay. And what are your investment goals? Like, do you think of what you are investing towards, like a BTO or a car or even, you know, just a really big holiday?

Okay. So, my investment goal is really to retire at a younger age. Oh, okay. So, basically, my thought process is that I hope to acquire enough assets that could generate, like, sufficient cash flow for me in the future. So, to the extent that I face less financial pressure in my career. So, I do not really think investment as an avenue for me to retire entirely, but rather to just reduce my financial pressure and just enjoy life in general.

Wow. Okay. So, you're thinking of retirement age 20. That is very, very wise, I think. Yes, agreed.

So, I think, Prof, the last question for you is what skills or mindsets do you think are important when people get into investing? I think you've spoken about the practical things they should and shouldn't do. But in terms of, like, mindsets or even, you know, analytical skills, for example, what do you think is important? Yeah.

I think from a mindset perspective, it's that desire to start small and learn. You got to start with this as a learning journey, right? So, that first step, you know, every journey of a thousand miles, right? So, if you start with a good first step, that gives you time to learn. And then be curious, right? Go out there and learn as much as you can. Read a lot. Again, I personally would say, you know, a lot of the stuff on social media is probably not where I would go for your fundamental understanding of investing. But at the same time, you know, where do you go and what kind of mindset do you bring? You know, don't freak out. Markets go up. Markets go down. You know, I remember I was 20 in 1990. We'd just come through, you know, the 87 crash. We were in a recession. Is that a good time to invest? Not a good time. You know, I started investing as soon as I graduated and had any income. Then, you know, dot-com bubble burst, you know, and if you look at where the stock market was at that point in time, people freaked out. The market's so much higher than that. Working at a hedge fund while the Lehman Brothers and the whole global financial crisis unfolds, the market's so much higher than that. So, just give it some space. Don't look at your portfolio every day. Recognize that there's a lot to learn. And don't think that it's all on you to be the most skilled investor in the world. You won't be. It's just, you know, that's the honest truth. You probably won't be. There's one Warren Buffett in this universe. His name is Warren Buffett. It could easily be somebody else in a parallel universe. It's probably not going to be you. But that doesn't mean that you can't do well for yourself by kind of being patient. And being thoughtful as you start your investing journey.

Thank you. Well, that's a wrap for this first episode of Head Start on Record. Thank you, Prof. Matt and Victor, for your insights. It was a pleasure to have both of you on our show.

I'm Suen Tan. You can email us your thoughts on this issue or suggest another question you'd like to see me tackle next time on the show. You can also reach out to me on LinkedIn. And if you'd like to read my articles and the Head Start newsletter, all these links are in our podcast show notes. This podcast episode is edited by Amirul Karim. Stay tuned then. Thanks for listening.

Send your feedback to podcast at sph.com.sg. Find us on Apple Podcasts, Spotify, or within our Straits Times app. Thanks for listening. Do note, all analyses, opinions, recommendations, and other information in this podcast are for general information only. We love to listen.

If you have any questions or activities that we may need help with, Bye for now. Thanks for listening. Bye-bye. Bye-bye. Take care. Take care.

AI Content

الميزات الأساسية

استمتع براحة النسخ السهل. قل وداعًا للنسخ اليدوي والحواجز اللغوية. ابدأ اليوم!

دقة على مستوى البشر.

- يسخر ذكاؤنا الاصطناعي قوة التعلم الآلي لتوفير تعرف ممتاز على الكلام.

اكتشاف المتحدث.

- يمكنه التمييز بين المتحدثين المختلفين بسهولة، مما يضفي الوضوح على نصوصك المكتوبة.

دعم متعدد اللغات.

- يدعم ذكاؤنا الاصطناعي أكثر من 38 لغة، مما يجعله حليفك المثالي في عالم متزايد الترابط.

نسخ متعدد الاستخدامات.

- من اجتماعات زوم والبودكاست إلى المحاضرات وأكثر، ذكاؤنا الاصطناعي يغطي كل شيء.

لخصه.

- هل تحتاج إلى ملخص موجز؟ يمكن لذكائنا الاصطناعي استخلاص جوهر ساعات من المحادثة.

الخصوصية.

- خصوصيتك مهمة. نعالج ملفاتك بأمان، ولا نشاركها أبدًا مع أطراف ثالثة، ونسمح لك بحذف الملفات بعد الاستخدام، مما يضمن بقاء بياناتك سرية ومحمية.

اللغات المدعومة

تدعم خدمة النسخ بالذكاء الاصطناعي لدينا مجموعة واسعة من اللغات. سواء كنت بحاجة إلى خدمات النسخ للاجتماعات أو المحاضرات أو البودكاست أو المحادثات اليومية، فإن ذكاءنا الاصطناعي يدعمك.

قدرات نسخ شاملة لمدخلات صوتية متنوعة

نصوص دقيقة وسريعة وموثوقة من أي مصدر صوتي.

- محول الصوت إلى نص

- تحويل ملفات الصوت إلى نص بدقة عالية.

- محول الفيديو إلى نص

- استخراج النص من ملفات الفيديو بسرعة وسهولة.

- انسخ فيديو يوتيوب

- انسخ أي فيديو يوتيوب إلى نص قابل للقراءة.

- سجل الصوت

- سجل الصوت من الميكروفون الخاص بك وانسخه إلى نص.

- التكامل مع Zapier

- نسخ وسائط مختلفة من Zapier لإنتاج محتوى الذكاء الاصطناعي.

أنشئ بشكل أسرع مع الذكاء الاصطناعي.

جربه بدون مخاطرة.

توقف عن إضاعة الوقت وابدأ في إنشاء محتوى عالي الجودة على الفور بقوة الذكاء الاصطناعي التوليدي.