Suppose that in a small town, the market for cement had five companies with market shares 0.3, 0.2, 0.2, 0.2, and 0.1. The following year, a new firm entered but the leading firm increased its share. Now the shares are 0.5, 0.1, 0.1, 0.1, 0.1, and 0.1. Did the market become more competitive or less competitive?

Economics Solver

Solve economics problems step-by-step with clear explanations. Upload a photo of your economics question or type it in, and get instant, accurate solutions. Ideal for students and professionals needing help with microeconomics, macroeconomics, graphs, and calculations.

Harness AI to dramatically speed up your content creation

Our AI-powered tool can generate high-quality, tailored content in seconds, not hours. Boost your productivity and focus on what really matters.

Use Cases

Discover how this template can be used in various scenarios

Economics Students

Solving microeconomics and macroeconomics problems, graphs, and calculations for assignments and exams.

Teachers and Professors

Explaining economic concepts and problem-solving methods in lectures or tutorials.

Business Professionals

Analyzing supply and demand, market equilibrium, and economic scenarios for business decisions.

Policy Analysts

Evaluating economic models and outcomes for research or policy recommendations.

Lifelong Learners

Exploring economic concepts and practicing problem-solving for personal interest or test prep.

How to use the Economics Solver

Economics Solver Templates & Examples

Frequently asked questions

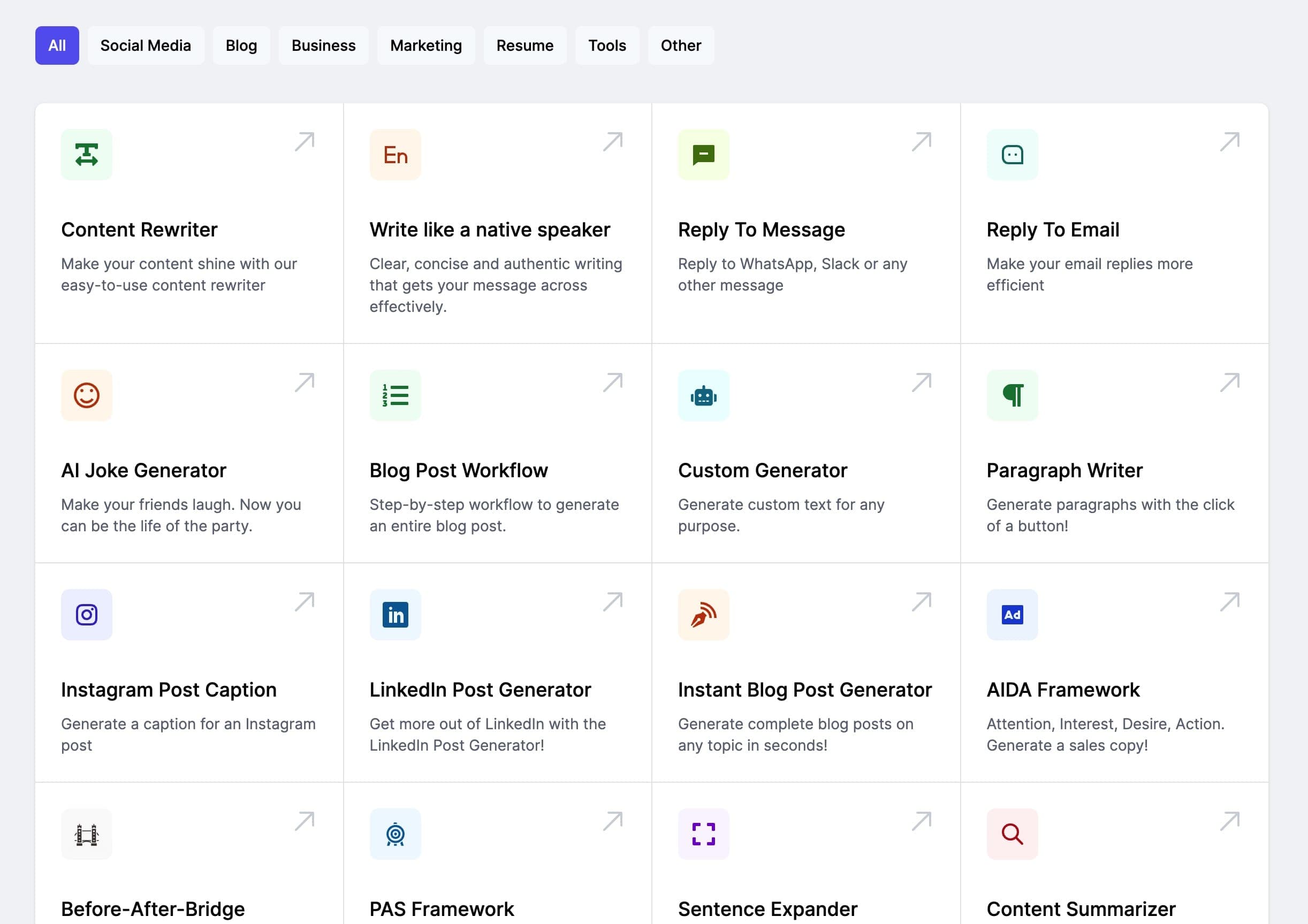

Check out these other templatesSee all →

Easily solve math problems step-by-step with detailed explanations. Upload a photo of your math question or type it in, and get instant, clear solutions. Perfect for students and anyone needing fast, accurate math help.

Solve accounting problems step-by-step with clear explanations. Upload a photo of your accounting question or type it in, and get instant, accurate solutions. Ideal for students and professionals needing help with accounting concepts, calculations, and journal entries.

Solve statistics problems step-by-step with clear explanations. Upload a photo of your statistics question or type it in, and get instant, accurate solutions. Ideal for students and professionals needing help with statistics concepts, calculations, and data analysis.

Solve physics problems step-by-step with clear explanations. Upload a photo of your physics question or type it in, and get instant, accurate solutions. Ideal for students and professionals working with mechanics, electricity, waves, and more.

Solve geometry problems step-by-step with clear explanations. Upload a photo of your geometry question or type it in, and get instant, accurate solutions. Ideal for angles, triangles, circles, coordinate geometry, and proofs.

Answer history questions with clear, structured explanations. Upload a photo of your history question or type it in, and get accurate answers with key dates, events, and context.

Solve biology questions with clear, step-by-step explanations. Upload a photo of your biology question or type it in, and get accurate answers across cell biology, genetics, physiology, and more.

Create Faster With AI.

Try it Risk-Free.

Stop wasting time and start creating high-quality content immediately with power of generative AI.