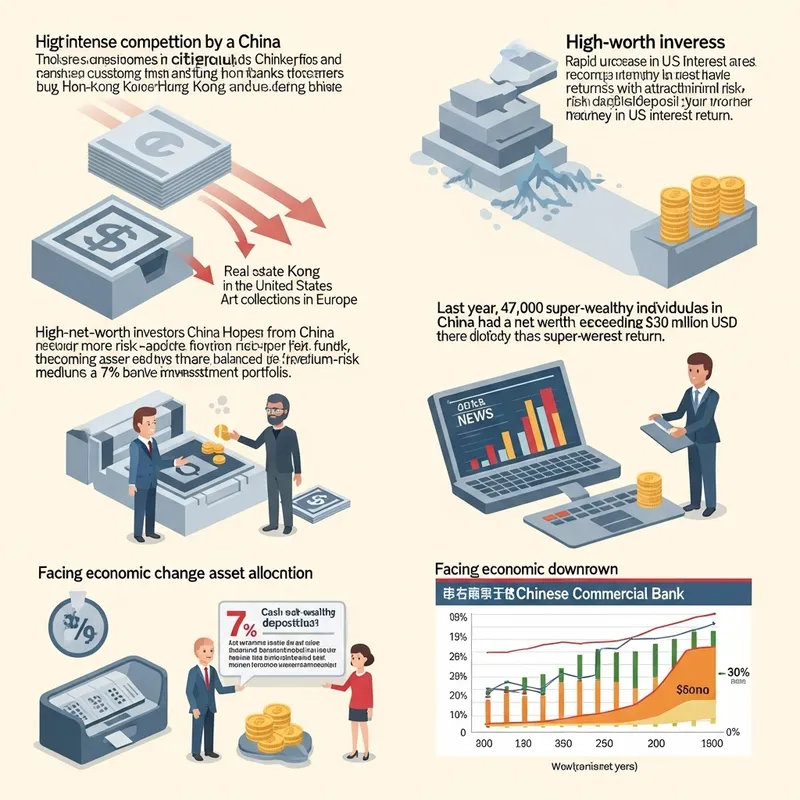

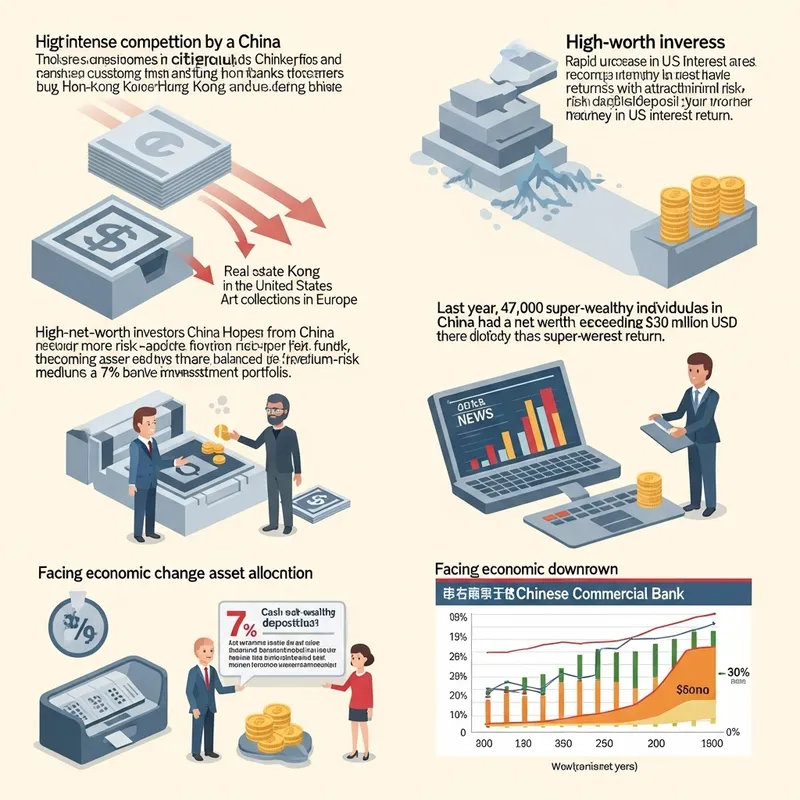

Intense Competition Among Foreign Banks Targeting High Net Worth Individuals in China

Prompt

An illustration depicting the intense competition faced by foreign banks like Citigroup and JPMorgan to gain business from high net worth individuals in China. It shows these banks assisting customers in buying shares in the Hong Kong stock market, real estate in the United States, and art collections in Europe. However, as the economies of mainland China and the Hong Kong stock market trend downward, these banks' business models are under stress. High net worth investors from China are becoming more risk-averse, favoring putting their funds in safer investment channels like deposit accounts. A fraction of these investors are shown to be more open to accepting more balanced, medium-risk investment portfolios. On the sideline, a news report mentions the rapid increase in US interest rates in recent years, attracting these wealthy individuals with attractive returns for minimal risk as they deposit their money in US banks for a 7% interest return. Additionally, data indicates that last year, over 47,000 super-wealthy individuals in China had a net worth exceeding $30 million USD, although there was a 7% reduction in the number of these super wealthy individuals. Facing economic downturn, these wealthy individuals are shown gradually changing their asset allocation. A chart from a Chinese commercial bank shows that over the past three years, the proportion of cash and deposits held by these wealthy individuals has been increasing, with some showing a preference for buying gold.

More images like this

Create Your Own AI Images

Generate stunning AI images with our easy-to-use image generator

Supported Styles

Our AI image generator supports 20+ styles and all diverse styles - just select the appropriate style and enter text in your language of choice.

Oil Painting

Realistic Photo

Cyberpunk

Watercolor

Pencil drawing

Cartoon

Disney

Pixar

Disney Poster

Movie Poster

Anime

Mosaic

3D Model

Portrait

Icon

Sticker

Landscape

Pokemon

Logo

Business Card

Band Logo

Furry

T-Shirt Design

Jersey

Hoodie

Tattoo

Birth Flower Tattoo

Fantasy

Fantasy Map

DND

Album Cover

Pixel Art

Coloring Page

Coloring Book

Texture

Animal

Car

Lego

Minecraft

Hello Kitty

Mascot

Superhero

Monster

Sewing Pattern

Crochet Pattern

Clothing Design

Architecture

Character

Baby

Book Cover

Book Illustration

Outfit

YouTube Thumbnail

Banner

Sprite Sheet

Caricature

Scene

Mugshot

Face

Human

Food

Yearbook Photo

Graduation Photo

Vintage Photo

Christmas Photo

Christmas Card

Muppet

Cake

Costume

Cat

Dog

Jewelry

LinkedIn Profile Picture

Graffiti

Product Design

Bible Art

Sketch

House

Home Exterior Design

Landscape Design

Fusion

Doodle

Stadium

Patch

Planet

Silhouette

Postcard

Family Crest

Stained Glass

Van Gogh

Warhol

Picasso

Leonardo da Vinci

Claude Monet

Salvador Dali

Jackson Pollock

Mark Rothko

Kandinsky

Gustav Klimt

Hokusai

Vector (SVG)

Cyborg

Synthwave

Neonpunk

Analog

Product Photography

Celebrity

Line Art

Avatar

Background Art

Concept Art

Photo Restoration

Game Assets

Fashion Design

NFT Art

Packaging Design

Comic Creation

Pattern Art

Character Design

Restaurant Menu Design

Podcast Cover

Instagram Post

Luxury Lifestyle

Selfie

Dating Profile

Glamour

Old Money

Speaker

Fitness

Muscle

Mythical Creature

Villain

Ghibli

Isometric Art

Chalk Art

Holographic

Art Nouveau

Collage Art

Steampunk

Claymation

Glitch Art

Gothic

Furniture

Uniform

Pet Portrait

Nail Art

Horror Art

Pop Art

Typography Art

Action Figure

Fight

Wedding Photo

Age Progression

Tarot Card

Magazine Cover

Dragon

Political Cartoon

Therapist Headshots

Lawyer Headshots

Comedian Headshots

Teacher Headshots

Life Coach Headshots

Doctor Headshots

Real Estate Agent Headshots

Model Headshots

Corporate Headshots For Your Team

Author Headshots

Dating Headshots

CEO Headshots

Actor Headshots

Professional Headshots

LinkedIn Headshots

Dancer Headshots

Outdoor Headshots

Personal Trainer Headshots

Chef Headshots

Nurse Headshots

Hair Stylist Headshots

Musician Headshots

Interior Designer Headshots

Insurance Agent Headshots

Dentist Headshots

Financial Advisor Headshots

Infographic

Poster

Invitation

Flyer

Moodboard

Instagram Photos

Halloween Photos

Fitness Influencer

Polaroid Photos

Tinder

Hinge

Yoga & Wellness

Entrepreneur

Bumble

Beach Bikini

Girlfriend

Chinese New Year

Hanukkah

Hair Color Try On

Weight Loss Simulator

ASCII Art

Create Faster With AI.

Try it Risk-Free.

Stop wasting time and start creating high-quality content immediately with power of generative AI.